Cashless payment has become the newest trend. The digital wallet apps have shown to be successful for both consumers and companies. Professionals from various fields, including network operations and banks, believe that mobile payments will swiftly replace traditional wallets in the long run.

Before we go any further, let us explain what an e-wallet is. An Electronic wallet is a smartphone-based secure design that secures and stores its users’ financial information and transaction details. It also enables the fast and accurate handling of making and receiving payments.

The number of digital wallet apps available on various app stores has increased. The availability of numerous mobile wallet applications on smartphones is expected to increase consumer use of digital wallets. Personal digital wallets have been developed by major technology companies such as Alibaba, Tencent, Google, and Facebook. According to a recent finder.com survey, about 150 million Americans have used a digital wallet at some stage of life.

Digital wallet apps have shown to be successful for both consumers and companies. Digital wallet transactions are becoming increasingly frequent in today’s market, regardless of the type of business. The eWallet apps are predicted to grow in popularity in the future since they provide a convenient way to make payments.

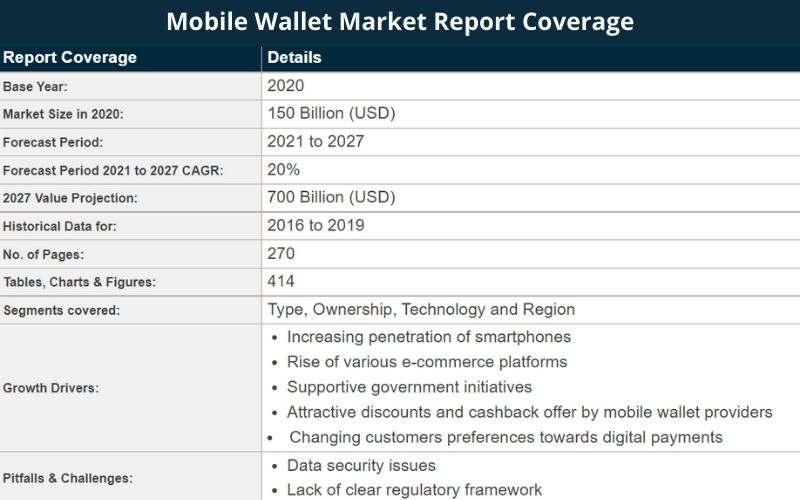

According to global market insights, the mobile wallet market surpassed USD 100 billion in 2020. It is predicted to increase at a CAGR of more than 20% between 2021 and 2027. In 2020, the global mobile transaction volume has surpassed 100 billion, with a transaction cost of nearly USD 6 trillion.

There are several difficulties that developers may face when developing an eWallet software that is not just technological. Here we list out the challenges of developing eWallet apps for you, have a look.

7 Difficulties In Building eWallet Apps

1. Customer Mindset

Changing customers’ mindsets is one difficult task but convincing them will somehow bring amazing results to the eWallet app. Customers have long used cash, cheques, and occasionally ATM cards to negotiate deals. Some of them often use credit cards. The reason behind this is that people are still unaware of the benefits of using e-wallets. One strategy to raise awareness among them is to send them notifications about the great offers related to payments to specific merchants. You must assure them of the service offering, safety, convenience, usability of the system, and significant cost savings in app development. Therefore, it is significant to expand the mindset of customers.

2. Lack Of Trust

As per the research done by YouGov, more than 40% of smartphone operators have trust issues with eWallets. A comparable number of people are anxious that if their phone is stolen, they will lose all of their money. If people don’t have trust in eWallet they will not feel secure to keep their money in eWallet. Privacy and confidentiality are the main concern of people. People must be educated on the value and convenience of adopting a digital wallet. Experian conducted a study that found that 55 percent of consumers feel safer using credit cards. According to an Auriemma poll, people who use e-wallets will not promote them to their relatives or friends.

3. Less Alertness

Many consumers believe that carrying cash is more efficient and simpler to handle. They believe that mobile eWallets are too complex to use and are not meant for them. You can train them in using their eWallets using easy voice commands of point and pay techniques with proper awareness programs. They need to be aware of the credibility and reliability of the digital wallet.

4. Fraud Detection & Mitigation

It is significant to take care of frauds that create problems in digital wallet app development. People who are unfamiliar with eWallets are easily fooled. Digital wallet payment risk is associated with data theft, data leak, malware attack, hacking, etc. This risk is one of the main reasons why many individuals avoid eWallets using eWallets or abandon them. Over the years technology has advanced so much that this threat can be avoided by developers. Nowadays, most digital payment apps are compliant with EU- GDPR (General Data Protection Regulation) compliance.

5. The Need For Regulatory Compliance

All digital payment services must comply with legal standards. Money and finance are strictly regulated by the central bank. You cannot provide certain eWallet services if a government does not allow them. You should select a mobile wallet app development company that is familiar with current norms and regulations in the target countries. It is also preferable to comprehend the terms and conditions. If there is a significant deviation in the compliances, the owner will have to face legal concerns. Although Emizen Tech’s Wallet mobile application development team is aware of the issues in most countries, a clear set of instructions would be preferable.

6. Technological Hurdles

For an expert eWallet app development business, creating a safe, fast, easy, and feature-rich eWallet application of any type is a complex task. Therefore, you should hire an eWallet app development firm with suitable experience to ensure that your project is completed to your satisfaction. Their knowledge will assist you in creating an eWallet application and guide you toward making it effective in a short period. Artificial Intelligence and Machine Learning technology are transforming it simpler all over the globe to make reliable and technologically advanced e-wallet applications.

7. No Rewards

When it comes to mobile wallets, unlike cards and cash-back schemes, there are no benefits. Coupons, prizes, and discounts are offered to those who pay with credit or cash. Financial marketers who want to increase the use of mobile wallets should take advantage of the opportunities.

Conclusion

Electronic wallets will eventually replace credit/debit cards and virtual currencies as the primary payment mechanism. eWallet transactions are one of today’s trendiest sectors, thanks to the convenience of mobile devices. If you’re preparing to launch an eWallet then it’s a good app idea to consider the key challenges and trends in eWallet app development. The first step should be to choose an expert eWallet app development company with professionals who are familiar with the process and rules and regulations.

USA

USA UK

UK