It’s a year back tale when we need to wait for a long to send or receive money from our family and friends within the city or county. The commencement of digital platforms has eased users to get money quickly and safely.

In the market, you will witness various peer-to-peer payment apps ruling the world, meeting the users’ money transfer needs. Venmo also holds a position in the list of digital wallets.

In this post, we will dig deeper to learn special facts about Venmo, how it makes money and works, how to integrate it into your app or web and e-commerce stores, benefits for users and businesses, and more.

Brace yourself and get started for an informative write-up.

What Is Venmo?

First, let’s get deeper to know when did Venmo start?

Venmo was founded in 2009 and started as a text-based payment delivery system. In 2012, the company invented a platform with social network integration to capitalize on expanding the p2p economy. After over six months, Braintree’s mobile payment system, used by Uber, Airbnb, and other popular eCommerce brands, acquired the Venmo platform for $26.2 million. A year later, when Paypal Holdings Inc. acquired Braintree for $800 million, that resulted in a substantial boost in Venmo users & monetization base.

Now, moving ahead, we will learn what is Venmo.

Venmo is also well known for the public feed of transactions. It displays a social media feed for transactions in many ways that you may comment on or like on these feeds. People use emojis to detail the reason for the transaction.

Though focusing on personal privacy, you can make your transactions private, and you still need to add a note regardless. Additionally, you can use Venmo on the web for payments. The company announced that feature to roll out in 2018.

How to Set up a Venmo Account?

You can set up your Venmo account easily by following the below steps:

- Download the Venmo app on your device.

- Create and register an account by choosing your payment settings (public, private, or friends are available).

- Connect your bank and debit card.

How To Use Venmo to Send Or Receive Money?

The Venmo app is widespread and easily accessible to users globally. Here are the steps to send or receive money:

- Click on the circular icon (pay/request button) from the bottom right corner of the app.

- Choose the person/contact you want to make payment.

- Enter the amount and press whether you are paying or requesting money.

- Above the pay tab is a button to display who can review the transaction reasons.

Choose from private, public, or friends. Later the transaction will be entirely hidden from the timeline. Otherwise, by default, the description will be public.

Is Venmo Safe?

Using multiple security measures, Venmo secures your financial information. Also, the app encrypts every transaction and the personal details the user offers, storing them in safe locations.

Moreover, the Venmo payment service app automatically monitors the user’s account activity to block suspicious activity. Any unauthorized transaction can’t be successful if conducted via this app.

Most users consider this app safe and trust it for payment transactions.

Who Can Use Venmo – Leverage the Benefits of Venmo

The user should be 18 years old or more.

He needs to be physically residing in the US.

He should own a US cell phone number linked with only one Venmo account.

He should have a bank account, debit card, or credit card.

How Does Venmo Make Money? (Business Model, Monetization model)

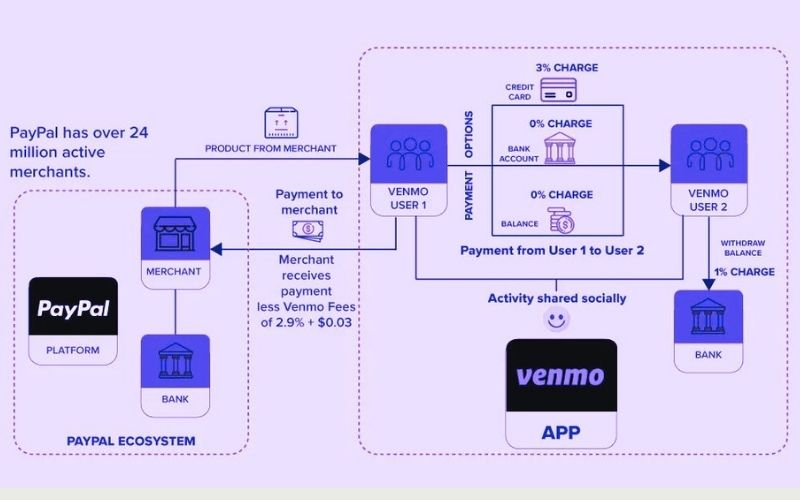

Charging no fees for sending or receiving payments, Venmo generates revenue through its withdrawal and interchange fees, checking checks fees, interest on cash, affiliate commissions on the cashback program, and affiliate commissions.

In partnership with Mastercard (MA), Venmo offers a debit card. Consequently, the users use their Venmo balance to purchase from anywhere, as MasterCard is accepted in the US.

How Does Venmo Make Money – Service Charges

1. Instant Transfer

This feature was enabled in Venmo in 2019 and turned into a significant revenue stream. Users who don’t want to wait for 1 to 3 days to transfer the Venmo money to their bank balance can instantly transfer it. Venmo charges users a 1% fee on each transaction, with a minimum of $0.25 and a maximum of $10.

2. Cash a Check

In January 2021, Venmo launched the cashing service. The company charges users a 1% transaction fee with a minimum $5 check amount.

3. Pay With Venmo, Venmo Debit Card

This is the major revenue stream of Venmo. The app charges a $0.30 transaction fee and a 2.9% merchant fee on every request of payment. It’s similar to visa or MasterCard charges. POS counters that accept MasterCard accept payments from Venmo cards as well.

4. Interchange And Withdrawal Fees

For transaction processing, Venmo charges interchange fees to merchants. While withdrawing the payment from ATM, users need to pay a $2.50 fee and a $3.00 fee while withdrawing funds at bank tellers.

5. Cash Interest from Loans

The platform loans cash to the bank from its system in return for an average landing fee of 3.35% in 2019.

6. Cashback Program

Similar to other debit cards, the Venmo platform offers a cashback reward feature with their Venmo card. The reward varies from 1% to 2% of the transaction value. Some partner merchants offering cashback programs include Chevron, Papa Johns, Target, Dunkin’ Donuts, and more.

7. Cryptocurrency Fees

In 2021, Venmo launched one more option to purchase and sell cryptocurrencies via this platform. Currently, in the US, customers can transact in only four currencies: Bitcoin Cash, Litecoin, Bitcoin, and Ethereum.

Venmo uses its crypto products to make money via a spread and transaction fees. The former is the difference between the market price Venmo gets from Oaxos, its trading partner, and the exchange price between the crypto asset showcased to the user. and US dollars.

The spread relies on the current market scenario, like US dollar strength. Venmo gets an amount in turn for each sale or purchase.

Amazing Statistics Of Venmo (you can compare Venmo with others too)

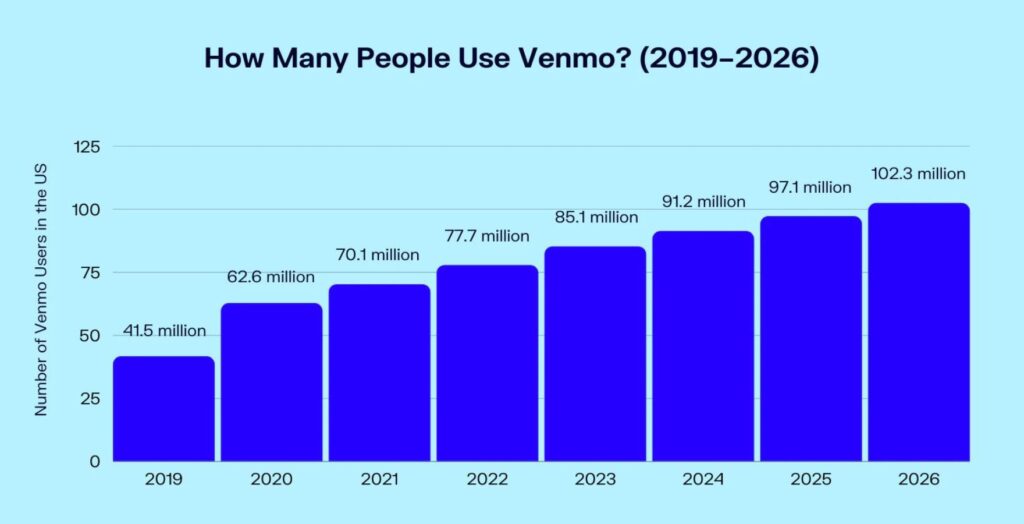

- By 2026, around $102.3 million people will likely opt for Venmo to reap the advantages of its payment service.

- Around 14% of adult Americans use Venmo for P2P transactions.

- In 2019, Venmo had 50+ million active accounts, which will increase in 2023 with about $78 million active users.

- On average, Venmo transfers around $60.

- By the end of 2023, Venmo will process approximately $244 billion in total payment volume.

- Over 7 million Venmo users are in the 18-30 age group.

- Venmo processed near about $160 billion in total payments in 2020.

- 30% of small businesses even have yet to hear about Venmo.

- 60% of Venmo customers are male.

- Emojis make the Venmo payment service unique and necessary for the Venmo experience.

How Does Venmo Work?

A cash-free mode of sending and receiving money, Venmo is very useful for varied money transfer needs, like splitting expenses with friends, paying a part of shared expenses, and more.

Now, the question arises, how does Venmo work technically? Generally, European, MasterCard, and Visa (EVM) payment system architecture includes customers, issuer, devices (on which it’s operated), merchant’s POS, and acquire.

Let’s get the right answer to this by reviewing Venmo architecture (working) below:

Besides, Venmo business model is not limited to sending and receiving money; with this app, you can:

- Make a purchase using an in-store QR code.

- Use Venmo’s Mastercard debit card and make purchases anywhere in the US (where this card is acceptable).

- Get price alerts about chiefly four sorts of cryptocurrency, Bitcoin cash, Litecoin, Ethereum, and Bitcoin, that users can sell, buy, or hold via Venmo.

- Pay for various purchases using mobile websites and apps from authorized Venmo partners.

- By applying for a Venmo debit card or setting up direct deposit, you can cash specific checks post verifying your identity.

How To Integrate Venmo With Web/App?

You can follow the below steps to integrate Venmo with a web/app.

Before you know how to integrate the Venmo button into your checkout, you should ensure the following:

- You have a PayPal business account. If you are a new merchant, you should sign up for one.

- Next, complete “Get Started with PayPal APIs” to set up your PayPal account, sandbox emails, and client ID for testing.

- Last, complete a “standard Checkout integration.”

a. With Custom Website and Application Development

Add Venmo Button

1. You can add the Venmo button on your product and checkout pages by adding the JavaScript SDK code.

2. Decide where the SDK needs to render the Venmo button. Use the button options to regulate the button’s layout.

<!-- Set up a container element for the button -->

<div id="paypal-button-container"></div>

<!-- Include the PayPal JavaScript SDK. Replace `YOUR_CLIENT_ID` with your client ID.-->

<!-- Note that `enable-funding=venmo` is added as a query parameter -->

<script src="https://www.paypal.com/sdk/js?client-id=YOUR_CLIENT_ID&enable-funding=venmo"></script>

<script>

// Render the Venmo button into #paypal-button-container

paypal.Buttons().render('#paypal-button-container')

</script>

Must-Follow Steps

- Enable Venmo as Your Preferred Payment Option

By default, Venmo is not visible as a funding source in your Checkout integrations. For that, you can:

Add enable-funding=venmo to your JavaScript SDK <script> as a query parameter to display Venmo as your payment option.

- Leave Space on Your Page for the Venmo Button

You can render the Venmo button under the vertical button stack (if it already exists) or ensure you spare a space n your page for the Venmo button.

- Show Payment Option Used

If you have a confirmation page or send a notification to the user showing the funding source being used, you can:

Use an onClick handler to showcase Venmo in the confirmation notification.

b. With Ecommerce Development

1. BigCommerce Store and Venmo Integration

On your Bigcommerce store, you can introduce Venmo as a new option to pay your customers.

To integrate the BigCommerce store with Venmo, follow the below steps:

- On PayPal’s Express Checkout for merchants (including those who are currently on Braintree [Only payment platform that provides PayPal, Venmo (in the US), debit, and credit cards]), you can upgrade to the new PayPal Checkout.

- On PayPal standard, for merchants, you can complete a simpler, new client-side integration as recommended.

Note: Expected development time may increase if it includes setting up PayPal Checkout (for the first time). But trust the process, as it will pay back your patience.

2. Shopify Store and Venmo Integration

Add Venmo as a funding source for the Shopify store’s checkout option using PayPal Checkout.

Being US based, if you already use PayPal Checkout, Venmo will automatically appear for the buyers as a payment option who pick Venmo to pay for their purchase. Purchases that buyers make via Venmo will be displayed on the Orders report as PayPal Payments.

3. Shopware Store and Venmo Integration

Venmo interaction with the Shopware store needs the assistance of an extension, PayPal, for Showare 6 (already installed in Shopware).

You can integrate varied PayPal products into your Shopware 6 online store with PayPal Checkout (a single module including PayPal Checkout, PayPal Express Button, and PayPal Pay Later).

The PayPal Checkout, PayPal’s all-in-one checkout solution, accepts PayPal Digital Payments, debit/credit cards, and local payments securely. Besides, it provides Venmo (US only) and more options crafted to assist you in increased conversions.

4. Woocommerce Shop and Venmo Integration

To integrate your WooCommerce store with the Venmo payment option, download “Checkout with Venmo,” a WordPress plugin that facilitates customers to pay via Venmo.

Steps to follow to set up WooCommerce Venmo integration:

- Log In to WordPress and Install the Plugin

- Configure your Payment Settings

5. Salesforce Commerce and Venmo Integration

Integration of Salesforce Payments with PayPal will let you use Venmo on your SFRA (Store Front Reference Architecture).

How to integrate Venmo into Salesforce Payments

- In a payments zone, if PayPal is already active, Venmo is selected for chosen PayPal checkout mode (express or multi-step) by default. [Deselect Venmo in the checkout configuration of the payment zone if you don’t want to offer it as a payment option).

6. OpenCart Store and Venmo Integration

- Go to the OpenCart extension and themes page

- Choose Payment Gateways from the Category

- Click on the PayPal Checkout Integration extension

PayPal Checkout allows the OpenCart store owners to provide PayPal, Pay Later, Venmo (US only), and more options. Ahead, it will automatically offer PayPal buttons at checkout and product pages.

Features of Venmo Digital Wallet

Today, with 10+ million people, Venmo is serving the entire US meeting their online payment needs.

Venmo is emerging as an ultimate game-changer in the world of eCommerce. Let’s unveil its top features:

| Pay Friends | With this payment option, you can send and receive money with your friends who have a Venmo account. |

| Easy Split Payment | Also, you don’t need to keep track of the split amount, as Venmo does it for you. Whether it’s groceries, rent, or utilities, this payment option app can do it for you by splitting your basic bills and settling them easily, letting every member pay for the shared activity. |

| Send a Gift | For those who want to celebrate generous moments with their loved ones, like birthdays, anniversaries, and more, Venmo can let them participate even in their absence by sending cash for coffee or anything. |

| Customized Cash Back | With the Venmo Credit Card, users can earn 3% ad more as cashback to spend, send, or auto-purchase the crypto of their choice from their Venmo account. |

| Spend & Shop | The users can purchase online and pay via Venmo as the online store owners have started integrating Venmo with the checkout page of their online shops. |

Benefits of using Venmo

For General User

1. Quick & Easy Payments

The chief factors of the popularity of Venmo are easy-to-use and no learning curve. Users can download it in minutes and start sending and receiving money.

2. Allow to Pay for Any Selected Business

While shopping with businesses accepting Venmo payments, the app can allow you to select any of them at checkout.

3. Adds Popular Features from Social Networks

Not just being a typical payments app, Venmo adds social network features, including comments, messages, and likes to every payment. Some users find it fun while conducting money transfers.

4. Provides a Debit and Credit Card

Users may prefer any of such cards to pay. Here, Venmo Debit Card comes tied with the user’s Venmo balance with no extra charge; instead holds cashback offers.

5. Charges No fee

Venmo is entirely free for sending money from a debit card, bank account, or Venmo balance until you request for paid instant transfer. Payments through credit card charges 3% per transaction, a standard amount like other payments app.

For Businesses

1. QR Code Payment Options

Venmo generates a unique QR code for every business. New businesses can request a QR code from Venmo and get a wallet card with a lanyard, a free QR kit (physical) with five coded stickers, and a tabletop display code. Businesses can provide their customers with a business QR code to get payment from customers via the Venmo app.

2. Low Fees

Venmo charges businesses an amount of 1.9% on received payments and 10 cents per transaction, which is less than other payment options.

3. Tax Forms

Per year, Venmo sends merchants a 1099-K tax form ( earning $600+ every year ) with new reporting needs in the American Rescue Plan Act of 2021. The proper tax form eases the tax payment process.

Key Points

- Round-the-clock customer support via mobile app chat, email, or phone.

- The free transfer takes 1-3 days and charges a 1.75% fee for instant ones.

- Businesses don’t need to sign any contract.

- Compatible with varied e-commerce platforms, Braintree and PayPal.

- Accept payments from credit, debit, and other prepaid cards post registration with the user’s Venmo account.

What Are The Top Competitors & Alternative Of Venmo?

1. Zelle App

Available on: Android, iOS

Areas of Operation: United States

Fees: No

Partnered with credit unions and leading banks, Zelle is safe, fast, and easy to send and receive money. In various banking apps, Zelle is one of the better ways to send money to your friends and family. You can send money for all sorts of things using this payment app.

Key Highlights

- Available in lots of banking apps.

- Free to use

- Use it with friends at different banks.

2. Cash App

Available on: Android, iOS

Areas of Operation: US, UK

Fees: No; Instant transfer – 0.50% to 1.75%

Now you can pay online instantly to anyone using the cash app, which is free to send and get money, bitcoin, or stocks. On everyday spending, this payments app offers exclusive discounts to users with Cash App Pay and Cash Card. It’s a simpler and faster way to bank without paying extra.

Key Highlights

- Buy Bitcoin and stocks.

- Free to send, buy, and receive Bitcoin, stocks, and money.

- Offer amazing discounts on routine spending.

- Easy investment into the stock market.

- Provide simpler banking.

3. PayPal

Available on: Android, iOS

Areas of Operation: Worldwide

Fees: 3.49% processing fee; $0.49 per transaction

Ease your online payment processing by choosing PayPal holding millions of users who send, receive, spend, and manage transactions. It’s one of the simple ways to transfer money while exchanging messages making transactions more interesting.

Key Highlights

- Buy, sell, and hold crypto.

- Digitize your wallet.

- Manage your subscription.

- Buy now, pay later.

- Pay with QR Codes.

- Add messages, and personalize the message to make it fun.

- Donate and support communities.

- Send money abroad.

- Pay bills and manage the balances.

4. Meta Pay with Messenger

Available on: Android

Areas of Operation: 144 countries worldwide

Fees: No

Facebook Pay, now Meta Pay, lets people pay money easily and securely in various places. You can use it on other social media websites, like Messenger, WhatsApp, and Instagram. Soon to be rolled out for other countries, Meta Pay o Facebook.

Key Highlights

- 24/7 customer care support via chat or email.

- Secure and protected payments.

- Process payment quickly.

- Allow payments through social media apps.

5. Payoneer

Available on: Android, iOS

Areas of Operation: US, EU, UK, and Japan

Fees: Free; 3% for credit card

Safe, cost-effective, and fast international payments are now possible across varied markets and currencies using Payoneer.

Key Highlights

- Accept credit cards and debit cards.

- Real-time payments.

- Recurring billing.

- Instant payment.

- ACH payments and eCheck processing

- Robust security measures

- Seamless and secure fund transfer

6. Braintree

Available on: Web

Areas of Operation: United States, Australia, Canada, Europe, Hong Kong, SAR China, Singapore, Malaysia, and New Zealand.

Fees: 2.9% + $0.30 per transaction

A global payment partner, Braintree is a PayPal service that exploits innovative payment technology to offer white-glove support and scalable solutions, which make it the most trusted and largest fintech brand worldwide. With this payment platform, merchants can expand markets, streamline business operations, diminish risks, and keep payment data secure.

Key Highlights

- Accept debit cards, credit cards, digital wallets payment, and more.

- PCI compliant with no extra charge.

- Multicurrency options.

- Complete payment type support.

- Help detect fraudulent transactions.

- Offer ket transaction insights.

7. Stripe

Available on: Android, iOS

Areas of Operation: 46 countries, including Europe, North America, Asia, and Oceania

Fees: 2.9% plus 30 cents per transaction

Join millions of all-sized businesses on this payments platform, Stripe, that helps send payouts, accept payments, and manage businesses online. It supports payments in various currencies and offers many extra services, like invoicing, billing, and sales tax automation.

Key Highlights

- Identify fraud.

- Send invoices.

- Manage business spending.

- Keep track of your business.

- Investigate disputes and all the failed payments.

- Compare business performance with historical data.

8. Apple Pay

Available on: iOS

Areas of Operation: Africa, Asia-Pacific, Europe, Latin America and the Caribbean, Middle East, and more.

Fees: Instant Transfer – a 1.5 percent fee

With an intent to replace your physical cards and cash, Apple Pay provides a safer, more accessible, more secure, and more private payment method. You can use it online, in stores, and apps.

Key Highlights

- Faster and easier to use cash or cards.

- In-built security and privacy.

- Accepted on millions of apps and websites.

- Easier checkout.

- Setup in seconds.

- In-built in iPhone.

9. Google Pay

Available on: Android, iOS

Areas of Operation:

Fees: 1.5% fee ( a minimum of 31 cents) for debit card transfers

Developed for India, Google Pay ease money transfer to your family, pay any merchant offline or online, recharge your mobile, pay a monthly bill, access past transactions, etc. Also, it lets the users earn rewards and scratch cards.

Key Highlights

- Use bank accounts to transfer money.

- Support BHIM UPI

- Offer rewards for everyday payments.

- Discover offers and discounts from your favorite places. Fast and easy payments.

- Safe money transfer.

- Contactless payments.

Cost Of Using Venmo

1. General use (send or receive money)

Venmo charges an amount chiefly for specialized transactions.

Credit card transfer: 3%

Cash checks: 1% ( min $5 for payroll and government checks), 5% (min $5 for other check types)

Fees to Receive Money – 1.9% + $0.10

Standard Electronic Withdrawal – $0.

2. Integrating Venmo cost

Receiving business payments (for goods and services): 1.9% + $0.10

Instant Transfers – 1.75% per transaction ($0.25 minimum and $25 maximum)

Seller Transaction Fees to Receive Money – 1.9% + $0.10

Instant Electronic Withdrawal – 1.75%

Adding Money Using Cash Check Feature – 1% (minimum $5) for government or payroll checks and 5% (minimum $5) for all other checks

Out-of-Network ATM Fee – $2.50

How Can Emizentech Help You?

Having a decade of experience, with time, Emizentech has attained the in-demand expertise in building any type of application, like a payment delivery app.

At Emizentech, we have a team of expert payment system app developers specialized in developing an app like Venmo’s digital wallet. We can also seamlessly integrate Venmo with your e-commerce store (app or web).

You can connect with our consultants, who analyze your business needs and craft a flawless pathway toward attaining them. Whatever your need, integrating a payment system into your e-commerce store or developing a payment app, we hold the caliber to assist you with what you want for your business.

Key Highlights of Our App Development Services

- Fair pricing

- Timely delivery

- 24/7 support

- Privacy and security

- Team of specialists

- Follow agile methodology

- Work on feedback at every milestone, etc.

Conclusion

Today, the Venmo business model has witnessed extensive growth offering a convenient and simple landscape for peer-to-peer payment transfer. The platform has expanded its services and unlocked varied revenue streams by leveraging its growing and wide customer base.

Suppose you are also devising to smoothly root up an akin payment system venture with no heavy workload. In that case, you can hire an app development company with an expert team of developers to help you attain your business objectives. Be set to explore the market and stay competitive among your contenders.

Connect with an app development company now!

USA

USA UK

UK